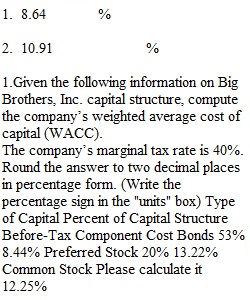

Q 1.Given the following information on Big Brothers, Inc. capital structure, compute the company’s weighted average cost of capital (WACC). The company’s marginal tax rate is 40%. Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) Type of Capital Percent of Capital Structure Before-Tax Component Cost Bonds 53% 8.44% Preferred Stock 20% 13.22% Common Stock Please calculate it 12.25% 2.The Black Bird Company plans an expansion. The expansion is to be financed by selling $184 million in new debt and $166 million in new common stock. The before-tax required rate of return on debt is 9.90% percent and the required rate of return on equity is 15.75% percent. If the company is in the 34 percent tax bracket, what is the weighted average cost of capital? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) 3.Garden Tools Inc. has bonds, preferred stock, and common stocks outstanding. The number of securities outstanding, the current market price, and the required rate of return for these securities are stated in the table below. The firm’s tax rate is 35%. Calculate the firm's WACC adjusted for taxes using the market information in the table. Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box) The Number of Securities Outstanding Selling price The Required Rate of Return Bonds 1,181 $1,176 11.86% Preferred Stocks 4,778 $83.86 15.52% Common Stocks 1,514 $123.48 16.41%

View Related Questions